As a fitness instructor, you might be wondering what tax deductions you can claim for. It's a common query around the end of the financial year and when you're putting together a tax return. Many fitness professionals - from personal trainers to group fitness instructors to yoga teachers and sports coaches wear many hats. As a result, they can have multiple income streams and incur a lot of expenses when carrying out their passion. How can you be sure you're maximising your earnings and you're claiming the right things as expenses and deductions?

In this article, we'll cover the following things:

More...

Tax deductions and expense claims

As famously stated by Benjamin Franklin - "... in this world, nothing can be said to be certain, except death and taxes."

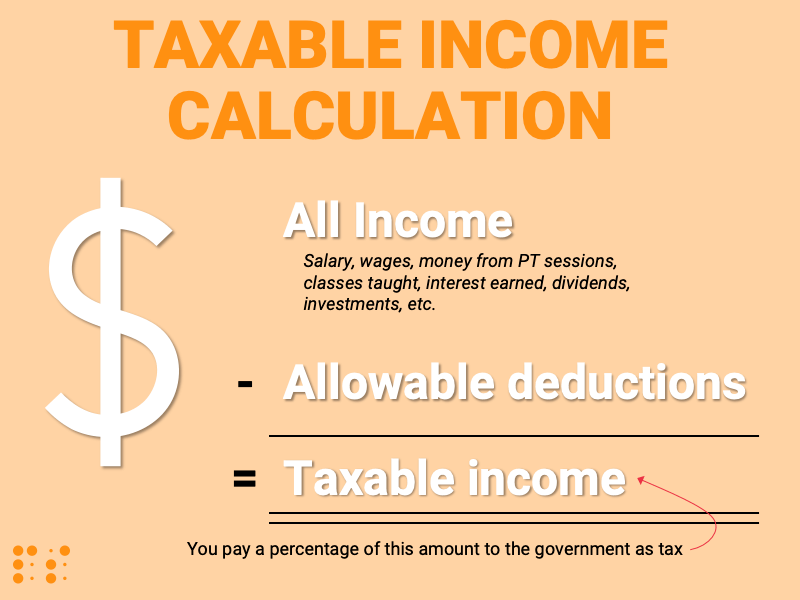

It's a fact of life - we earn money, we pay tax. You're probably already aware, but we pay income tax on all money you receive.

That is to say all income; from salary and wages to money for services and products that you sell, is taxable. You might work in a gym or you may be a freelance Personal Trainer. Alternatively, you may just teach an exercise class here and there and have another fulltime job in a different industry. Either way, you'll want to maximise the money that you get to 'take home' at the end of the day. Making claims or 'deductions' allow you to do this. Essentially, claiming deductions reduces the amount of tax you pay by lowering your taxable income.

Therefore, the more deductions you claim, the less tax you pay overall. Please note, the context of this article deals with reducing taxable income by way of allowable deductions. Offsets and rebates are also applicable in some cases which can also reduce the amount of tax you pay. You can read more on possible offsets and rebates on the ATO website.

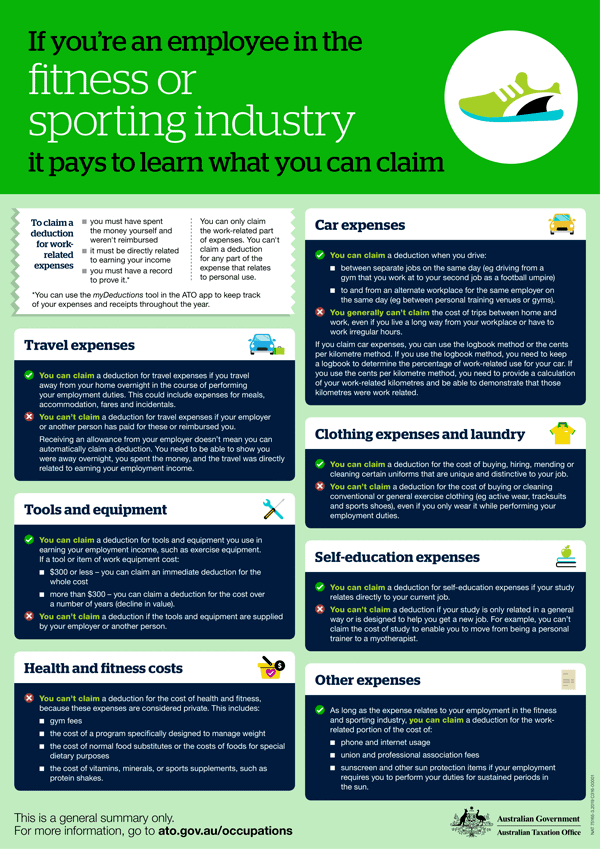

Requirements for making a claim

So now that you know the value of listing deductions in your tax return, you can just go about including everything you can possibly think of, right?!

Woah there, hold on! There are certain rules and requirements that determine if an expense is a valid deduction.

In general, deductions have to be directly related to earning your income. This will mean different things to different people. Some expenses you incur may have an element of personal and business use. Take your phone bills for example. You might use your personal phone to book in and follow up with clients. Perhaps you regularly take calls from the gym or studio you work at. Maybe you text round fellow instructors when you need a class covered. Some of the time though, it's likely your phone is more used to browsing your Facebook and Instagram newsfeeds. There will also be lots of personal calls and texts made too I imagine. To claim an expense when there is a mix of work and personal use, you can only claim for the 'work-related' portion. More on separating personal and work-related tax deductions for instructors and personal trainers later on.

In addition, to claim a work-related expense in your tax return you must;

- spend the money yourself without reimbursement

- have a record to prove it (more on this later)

For instance, sometimes we pay for things in the course of our working day in order to do our job. For me, as a FIFO (Offshore) Wellness Coach, sometimes I might have to purchase items in Perth and take these to the site with me for a specific event. Perhaps we have a Hallowe'en theme dinner and need decorations for the dining room. There isn't enough time to order online and get them delivered to a remote location, so I buy them in a shop myself. I keep the receipt and submit this to my company's finance department to be reimbursed for the cost of the items. They either pay me out of petty cash or I receive a payment into my bank account. In these cases, I can't claim the cost of the items in my EOFY tax return. The company reimbursed me - it's not my expense.

Common tax deductions for personal trainers and group fitness instructors

We can split expenses into several categories. Depending on your situation and how you earn your income some may apply more than others.

Car Expenses in the Fitness Industry

Most fitness professionals rely on their car somewhat for their job. Whether a fitness instructor or personal trainer can claim a tax deduction for this use though depends on some things.

As a general rule, you can't claim the cost of travelling from your home to your workplace as an expense. This is the case for most industries and job roles. Commuting is a general part of day-to-day life for most of us and the government views this the same way. Generally, we choose where we live and where we work. If we live a long way from our workplace or our hours are strange and varied, it doesn't matter. You can't claim a tax deduction for commuting.

You can claim expenses though if you drive between different jobs and workplaces on the same day. For example, a personal trainer could make an expense claim when he drives over to another studio for the class he teaches two nights each week. Alternatively, a fitness instructor who teaches at a chain of gyms (Goodlife or Fitness First, for example) could claim a tax deduction for the costs incurred driving from one gym to another during the course of their day.

To make a tax deduction for your car, there are two methods you can use to determine how much you can claim;

Logbook

The first is the logbook method where you need to keep a log or diary of how and when you use your car. The aim is to accurately determine the portion of work-related against personal use. For this method, you have to track ALL usage of your car for a minimum of 12 weeks. The purpose of each journey along with odometer readings at the start and end of each trip must be noted and written down. At the end of the representative 12 weeks, you then work out the percentage of personal use versus work use of your car. You would then claim a tax deduction for that percentage of all your car expenses for the year. You would also need to make sure you kept all receipts in relation to your car use. These might include fuel, servicing, repairs, etc. For me, that's a LOT of effort!

Cents per kilometre

Personally, I prefer the second option - the 'cents per kilometre' method. This is much simpler and straightforward. In a nutshell, you get to claim a set number of cents for every kilometre of work-related trips you drive. There's no requirement to keep receipts or a diary of your driving. You do, however, need to be able to show how you calculated your business distance. Personally, I just use google maps to get directions between the two locations and use that distance in my total.

For the 2018-19 tax year;

- you can claim $0.68 per kilometre of work-related travel as a deduction

- up to a maximum of 5,000 kilometres - that's potentially a $3,400 tax deduction for a busy fitness instructor

Note that if you choose to use the cents per kilometre method, this is the only expense you can claim for your car. You can't add in any others like depreciation, fuel, servicing, new tyres, etc. The method takes account for all possible expenses and lumps these into the one value.

In summary, it's completely up to you which method you decide to use. I like the simplicity of the second option. You're perfectly entitled to calculate your potential claim using both methods and use whichever one gives you the largest deduction.

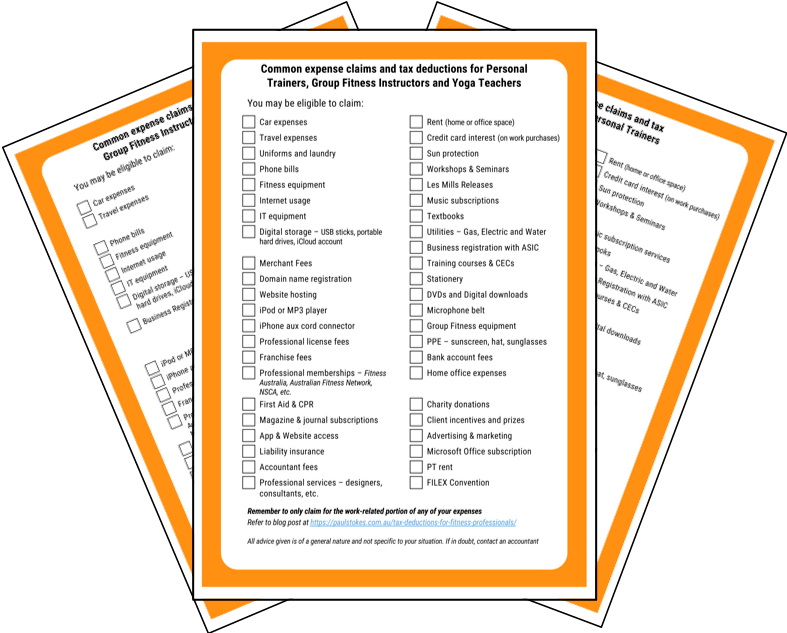

Download my FREE cheat sheet

Travel Expenses for Personal Trainers and Group Fitness Instructors

The industry offers many reasons why a fitness professional may need to travel away from home. Conferences, exhibitions, expos, seminars, workshops and training modules to name just a few.

For work-related travel overnight, you can include expenses for meals, accommodation, bus, plane and train tickets as well as other ad-hoc expenses that come up while you're away. If your employer or someone else paid the costs for you then you can't claim this as a tax deduction. Remember, you must have spent the money yourself. Again, receipts and evidence are essential here. Some employers may include a travel allowance in your salary package. Just because you receive this doesn't mean you can automatically make a claim. You need to prove you were away overnight and actually spent the money.

Some trips might incur a mix of business and pleasure. For example, maybe you travel interstate for the FILEX convention but spend a few extra days afterwards to see friends or do some tourist stuff. Again, you can only claim for the work-related portion of your trip. Maybe the conference is two days, but you end up being away for 5 in total. In that case, the fitness instructor might claim 40% (two fifths) of the airfare in their tax deduction. Similarly, a percentage needs to be apportioned for meals and hotel bills, etc.

Clothing Expenses and Laundry

This one often comes up in my network of fellow group fitness instructors and personal trainers.

I work in a gym. I need to wear gym clothes to exercise, so I can claim back the costs of these, right?

Wrong! (In most cases)

A personal trainer can't make an expense claim for the cost of their sports shoes they wear while training clients. Similarly, a group fitness instructor can't claim a tax deduction for the new top they bought and only wear to teach. You can't include general exercise clothing as a tax deduction. Even if you only wear it while performing work duties.

Some employers might stipulate you have to wear black pants and a white short-sleeved polo shirt. In the eyes of the ATO, "these items are conventional, not usually a specific type and not sufficiently distinctive or unique to your employer" so you can't claim any deduction for their associated costs.

What is and isn't a uniform

If you have a specific uniform that is unique and distinctive to your job, you might be able to claim. Many gyms require their staff to wear branded & personalised polo shirts. Perhaps even track pants sporting the gym's logo. In this case, there are some things you can put in your tax return. You can claim the cost of buying these uniform items if your employer requires you to do so. Your claim can also include the costs of hiring or mending these items.

You can also include as a tax deduction the cost of laundry for your work uniforms. It's worth noting you don't need receipts if you're claiming less than $150 for laundry expenses. That being said, you need to be able to show how you calculated the amount you came up with.

Some job roles might require personal protective equipment or PPE. I, for example, have to wear steel cap work boots in my FIFO fitness professional role. I can claim the cost for these in my tax return.

Group fitness instructors - definitely claim the cost of your microphone belt as a tax deduction. Les Mills-branded clothing, not so much.

Tools and Equipment

Different personal circumstances and requirements might determine what and how much you can claim for equipment.

If your income is derived solely as an employee then the amount you can claim depends on the item's cost.

If less than $300 you can claim back the cost of the whole item. A fitness instructor buying a bunch of resistance bands totalling $250 could include this cost as a tax deduction.

An employed personal trainer might spend $500 on a set of skinfold calipers - they can only claim a portion of this expense at tax time. Since the item is over $300, the PT needs to claim the depreciation as a deduction. That is to say, the cost is claimed back over a number of years, in subsequent tax returns, for the decline in value, not the cost of the item itself.

If you are self-employed, however, operating as a sole-trader with an ABN for example, then the rules are a little different.

For the 2018-19 tax year, businesses operating in this way can claim an immediate deduction for items up to $20,000 in value. No need to work out depreciation and spread the relative cost over several years. Simpler, quicker and potentially offering great returns.

Claiming self-education expenses for personal trainers and fitness instructors

Fitness professionals face a constant journey of upskilling and self-improvement. New programs, new courses, the latest training methods. Many organisations also require structured continuing education to remain current. Personally, this is where most of my tax deductions come from.

If the course or program of study directly relates to your current job then you can claim a deduction. All expenses incurred can be included in your tax return. These might be:

- registration fees

- textbooks

- stationery

- DVDs and digital downloads

- course materials

- travel expenses (if the course requires overnight travel)

Remember to include your first aid and CPR refreshers, Les Mills quarterly updates and the like.

Relevant training

You can claim for training and education that "maintains or improves specific skills or knowledge" you need in your current employment.

You can also deduct expenses for training that "is likely to result in – an increase in your income from your current employment."

What this means is that you can claim the costs of courses related to how you earn your living. You can't claim for a pre-vocational course, like a Cert III in Fitness that allows you employment in the industry in the first place. You're also not allowed to claim for courses that will allow you to gain new employment.

For example, a personal trainer who wants to become a massage therapist can't claim the cost of their massage training as an expense. A group fitness instructor who wants to be employed by a gym as a PT can't claim their Cert IV course as a tax deduction.

Phone Bills

I don't know a personal trainer or group fitness instructor who doesn't rely on their phone somewhat to earn a living. More often than not, they only have one phone. It's their 'personal' phone but it's used as a work diary, MP3 player for classes, contacting clients, colleagues, following up on leads, etc. While not ideal, it's certainly nothing to worry about. You're entitled to claim the work-related portion of the expense in your return. There are a few considerations to make though and there are different methods depending on how much you are claiming.

Claiming $50 or less

If the work use of your phone is incidental, and you are not claiming a deduction of more than $50, you may make a claim based on the following:

Claiming more than $50

To claim a deduction of more than $50, you must:

If your bills are itemised

Highlight all your work-related calls in a representative 4-week period. You can then apply this usage to the full year.

Bundled plans

You can keep

a diary covering a representative 4-week period showing how often you use each service for work. This pattern of work use can then be applied to the full working period.

To determine work use, you can record either:

Other tax deductions and expense claims for fitness instructors and personal trainers

As mentioned above, you can claim deductions for any work-related expenses you incur to earn your income. As long as the rules are followed, then there are a lot of things that can be included in the 'other' expenses category.

Allowable tax deductions you may not have thought of might include:

- Internet usage

- IT equipment and storage media

- Website hosting and domain name fees

- Merchant fees for EFTPOS facilities

- MP3 players and music equipment

- License fees

- Membership and professional registrations

- Prizes and client incentives

- Magazine, journal, app or website subscriptions (where applicable to earned income)

- Electricity and heating costs (if you work from home)

- Insurance premiums

- Accountant fees

- Professional services - designers, marketers, consultants

- Rent

- Interest on business purchases

I know many Les Mills group fitness instructors download their new release kits every 3 months. If you have a hard drive to back up these files onto, that would be an expense.

That little connector you need to plug your iPhone into the gym's music system. The one you always lose and have to buy again - that's an expense.

A personal trainer teaching an outdoor boot camp? You might need to wear sunscreen - include that cost in your tax return too. Remember sunglasses and hat would count as PPE too.

Download my free cheat sheet

Expenses Personal Trainers and Fitness Instructors can't claim as a tax deduction

So you see there are a huge number of expenses you could incur while you carry out your business. Up until now, we've focused mainly on the items a fitness instructor can claim a tax deduction for. There are some common things though that PTs and instructors wonder if they can claim in their tax return. Some things the ATO have ruled out.

Gym Membership

Your income depends on your ability to improve the physical fitness of other people. Surely it makes sense that you can claim the cost of improving your own fitness? Unfortunately, no.

According to the ATO, only professional sportspeople who require a level of fitness 'well above normal' may be eligible to claim. Personal trainers and fitness instructors are specifically ruled out. The ATO is very adamant about this.

Supplements and Food Replacements

Again, the ATO doesn't allow deductions for these items as they are deemed to be private expenses. Items specifically mentioned that you can't claim for include:

- food substitutes

- foods for special dietary purposes

- vitamins

- minerals

- sports supplements

- protein shakes

There you have it, straight from the source.

Gym Wear and Clothing

We did discuss this earlier, however, it pays to bring up again. You can’t claim a deduction for the cost of buying or cleaning conventional or general exercise clothing. This includes activewear, tracksuits, sports shoes. Even if you only wear it while performing your employment duties, you can't claim it as a tax deduction.

Straight from the ATO website:

"You can't claim a deduction for the cost of buying or cleaning plain clothing worn at work, even if your employer tells you to wear it. You can't claim for:

- heavy duty conventional clothing such as jeans, drill shirts and trousers

- general exercise clothing such as active wear or tracksuits

- running shoes or casual shoes.

These are private expenses."

There you have it folks

Expenses you didn't incur

For completeness, we'll also the fact that for an expense to be claimable, you must have spent the money yourself.

If you were reimbursed for the purchase, either by your employer or someone else, then you can't claim. If you don't have evidence in the form of receipts or invoices then this could land you in hot water with the government. Some expense categories have allowable 'limits' up to which point receipts aren't necessary. This doesn't mean you can automatically claim back that amount.

If you are audited, you'll be expected to show and prove that you spent the money.

Private and Personal Expenses

Some expenses aren't clear-cut as business expenses. You might use your computer to write up programs for clients or produce invoices and receipts. But you also might use that same computer for personal use. Your kids might use it for their homework, or that might be how you watch Netflix.

Other examples might be:

- Phone bill

- Internet usage

- Car expenses

- IT, TV and Sound equipment

- Utilities - gas, electric and water

- Rent

For items like these, you can only claim the 'work-related' portion of the expense. In the example of the computer above, you could work out how long you spend on it for work versus how long you use it for personal. Maybe it's 50/50. It might be just 10% personal use. Whatever the amount you come up with, make sure you have a valid calculation as to how you came up with it.

Being thorough

Record-keeping is extremely important. Keep receipts, invoices from suppliers, delivery notes - anything you need to prove that you incurred the expense you're claiming.

I'm a fan of spreadsheets - I keep all my expenses in one so at tax time, I have the totals ready to go.

That being said, sometimes things get missed. Expenses get forgotten about or receipts get lost.

Before finalising and submitting your tax return, it's a good idea to double-check for anything that might have been left out. You might like to run through the following to ensure all your bases are covered:

Check your emails

With more and more purchases being made online, transaction records often get emailed. Conduct separate searches for the terms 'receipt' and 'invoice' in your inbox. Browse through the results and seek out those emails containing your work-related expenses.

Bank Statements

Most bank accounts offer some sort of online transaction history. At the very least you should be able to download PDF statements you can skim through. Most have the option to filter results. So you can search for debit transactions within any given transaction and scroll through, looking for expenses you may have forgotten about. Granted, this is much easier if you have a separate business transaction account you make all your purchases from.

For many fitness instructors and personal trainers though this isn't the case. They often use the one personal account for all their income and expenditure, work-related or otherwise. Not to worry, just scroll through your statements and look for anything that jumps out. You might surprise yourself - that download you bought or subscription you purchased which slipped through the net.

Roll in the recap

That was a lot to take in! Some people prefer to leave things in the hand of their accountant. That's all well and good and they will ensure things you claim are valid and allowable deductions. Accountants aren't generally PTs and fitness instructors though and many might be unaware of the types of expenses you might incur. If you do go to a professional accountant, aim to find one who has experience of dealing with those from the fitness industry. You can also claim their fees in next year's tax return too!

Many personal trainers and fitness instructors prefer to submit their own tax return and claim their expenses and deductions themselves.

I do.

It doesn't have to be overly complicated and there are lots of useful guides out there to help you. The ATO online system gives step-by-step guidance for each section you need to fill out. There's no need to feel intimidated.

Get the FREE Tax Deductions Cheat Sheet

Want to make sure you haven't forgotten anything?

Download my cheat sheet to help you include everything you might not have thought about